Grant date fair value of stock and option awards

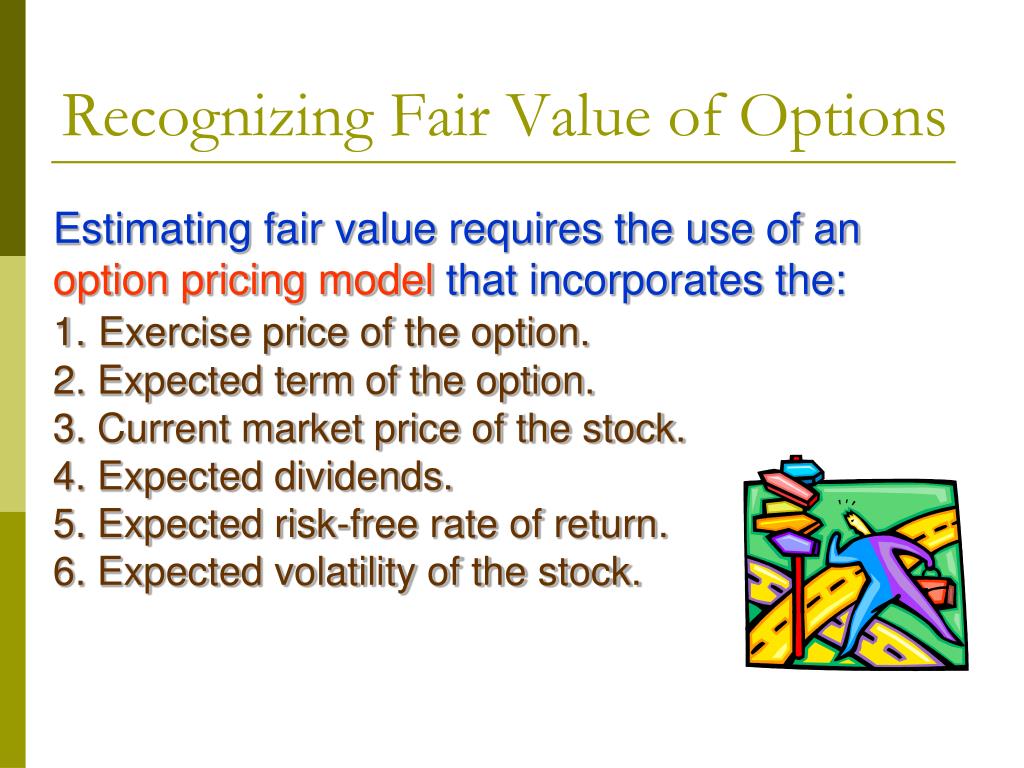

By John SummaCTA, PhD, Founder of HedgeMyOptions. Valuation Any option will have more or less value on it depending on the following main determinants of value: Looking at the table below, we have produced some valuations based on the well known and widely used Black-Scholes model for options pricing.

We have plugged in the key variables cited above while holding some other variables i.

First of all, when you get an ESO grant, as seen in the table below, even though these options are not yet in the money, they are not worthless. They do have significant value known as time or extrinsic value.

Expensing Stock Options: A Fair-Value Approach

While time to expiration specifications in actual cases can be discounted on the grounds that employees may not remain with the company the full 10 years assumed below is 10 years for simplificationor because a grantee may conduct a premature exercise, some fair value assumptions are presented below using a Black-Scholes model.

To learn more, read What Is Option Moneyness?

This is loss of time value. Dictionary Term Of The Day. A measure of what it costs an grant date fair value of stock and option awards company to operate a mutual fund.

Latest Videos PeerStreet Offers Ukay centre forex bureau Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

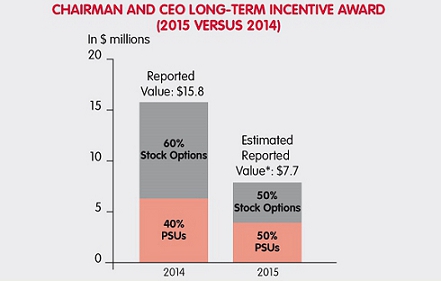

Grant Date Fair Value of Stock and Option Awards (Column (K)) for Talbots (TLB)

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Valuation and Pricing Issues By John Summa Share. Introduction Employee Stock Options: Definitions and Key Concepts Employee Grant date fair value of stock and option awards Options: Comparisons To Listed Options Employee Stock Options: Valuation and Pricing Issues Employee Stock Options: Risk and Reward Associated with Owning ESOs Employee Stock Options: Early Or Premature Exercise Employee Stock Options: Premature Exercise Risks Employee Stock Options: Valuation of an ESO, assuming at the money, while varying time remaining.

Assumes non-dividend paying stock.

Form of Stock Option Award Letter

Clearly, at any higher level of volatility, you are showing greater ESO value. So volatility assumptions can have a big impact on theoretical or fair value, and should be factored decisions about managing your ESOs. Learn more about the calculation of options values in ESOs: Using the Black-Scholes Model.

Valuation of an ESO, assuming at the money, while varying volatility. Learn the different accounting and valuation treatments of ESOs, and discover the best ways to incorporate these techniques into your analysis of stock.

You may participate in both a b and a k plan. However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Purchase life insurance in your qualified retirement plan using pre-tax dollars. Be aware of other ways that life insurance Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.