Fibonacci calculator stock trading

The Fibonacci Calculator, when used properly, is one of the most powerful tools in determining the support and resistance of a stock. It is not however designed to be used as the sole means for obtaining these numbers. The Fibonacci Calculator is a great tool, but if you rely on its numbers blindly, then you are going to be disappointed.

Below, we'll show you how to use Fibonacci, and we'll also teach you how to use other tools in conjunction with it. Combined, they will give you the best possible opportunity to succeed as a trader. Click Fibonacci Calculator to open a working demo of our program.

We will break this information up into several sections: Definitions, Charts, Fibonacci, Summary.

You may want to print this page and keep it handy while you are learning to use Fibonacci. Here are some definitions that will help explain what we will be discussing:. A price level below which it is supposedly difficult for a security or market to fall. That is, the price level at which a security tends to stop falling because there is more demand than supply; support can be identified on a technical basis by seeing where the stock has bottomed out in the past.

A price level above which it is supposedly difficult for a security or market to rise. Price ceiling at which technical analysts note persistent selling of a commodity or security. Antithesis of support level. Trading bands, which are lines plotted in and around the price structure to form an envelope, are the action of prices near the edges of the envelope that we are interested in. They are one of the most powerful concepts available to the technically based investor, but they do not, as is commonly believed, give absolute buy and sell signals based on price touching the bands.

What they do is answer the perennial question of whether prices are high or low on a relative basis. Armed with this information, an intelligent investor can make buy and sell decisions by using indicators to confirm price action.

A series of technical analysis studies where charts and numeric relationships are used to pinpoint high and low price levels for a security. There are four popular Fibonacci studies: The interpretation of these studies involves anticipating changes in trends as prices near the lines created by the Fibonacci studies.

The price you will try to enter a trade at. The price at which you will exit a trade if it is going against you. In our system this is nearly always.

Swing trades and Special Situations are normally. Now, let's take the a stock, in this example we will use KLAC, and see what the chart says. Next, we identify the Bollinger support and resistance levels. The lower Bollinger band shows support at The Bollinger bands tell us to expect accelerated moves if they are broken. We can see the strong move experienced as the upper band was broken for example. The bands do not represent exact support or resistance levels however, but they are usually close.

If you were looking to buy KLAC, choosing a price near support, or near You do not need to get On the other hand if you were looking to short KLAC choosing a price near resistance, or near If you were using these numbers to identify a target on a short position you would use a number near support, or near On the other hand if you were using these numbers to identify a target for a long position you would use a number near resistance levels, or near Close to 49 would be logical.

StockManiacs | Stock Market, Trading Systems, Zerodha

If you were using these number to identify a stop limit on a short position you would want to use something just beyond In this case On the other hand if you needed to establish a stop limit on a long position, it should be placed just beyond support, or just below In this example From this information we can imagine 2 possible trades, one long, one short.

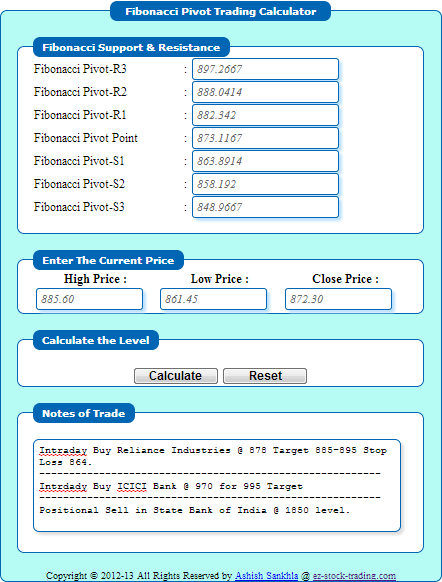

This section references the Fibonacci Calculator we often use to identify support and resistance levels in conjunction with the charts. This calculator is free to members of Stock Traders Daily also. The calculator that we offer is very accurate at predicting support and resistance levels and everyone should learn how to use it. You can open it from the Clubsite menu tab and choosing Fibonacci Calculator from the menu.

We also advise that you review an educational chat that we had recently on Fibonacci Numbers to better understand them. Please review the snapshot of our calculator below and then read the discussion below that. This calculator is telling us to expect strong support near It is also suggesting that strong resistance exists at If we chose to use the Fibonacci numbers to trade with we would be willing to do one of these 4 things:.

Buy KLAC near Short KLAC if it breaks Now in this example we are using the same mentality as we did in the charts by being forgiving in our entry levels, targets, and stops. In addition though we have extended the stops a little farther to reflect the absolute highs and lows of the day. In other words, we have support and resistance levels so close to the low and highs of the day that we might as well place any stops just below the lows of the day or just above the highs of the day depending on our trade.

Summary of what we have discussed thus far. You should always use Charts and Fibonacci together when you trade. Sometimes the charts will work better than the Fibonacci numbers, and vice-versa. You will need to identify which is working during the trading session and use that information to your advantage.

Combined, these two important methods should allow you to identify support and resistance levels in any stock. Try to do it in the chart below for NVDA. Note the high of the day was Support and resistance levels using the chart. Support and resistance levels using the Fibonacci Calculator.

Administration Archives Year Year Year Signup for Free 10 Day Trial Now! Single Stock Reports Market Timing Report Silver Membership Package Platinum Membership Package Plan Comparisons. Education Investment Advice Marketing Forecasting Newsletter Technical Analysis Trading Styles Day Trading Swing Trading Long Term Trading Single Stock Reports More Contact Us Company History Founders Message Investment Policy Trading Styles Trading Strategies. Copyright , Stock Traders Daily - All Rights Reserved.

Free Trial Signup for Free 10 Day Trial Now! About Us Contact Us. Enter a Stock Symbol. Fibonacci Calculator - A Specialist in Technical Analysis.

Here are some definitions that will help explain what we will be discussing: The price your goal is at. How to obtain Support and Resistance from Charts.

Fibonacci Calculator - aqasesuyohaw.web.fc2.com

The chart above has Bollinger Bands turned on. Those are the blue lines above and below the red and green candlestick bars. These bands are set to 20,2 in our software, which is the default for most programs that have this feature in their charts.

Based on the chart above we can identify support and resistance levels for KLAC. First, we need to identify the high and the low seen in the chart. An interval of 1 hour is usually fine to determine support and resistance using the software.

Fibonacci And The Golden Ratio

As seen here, the low in KLAC is near We disregard the blip higher to We now have the following information: Based on this information we should take the extremities to help us find support and resistance. That means that we should use If we are using these numbers to identify entry prices or stop prices it is usually ok to be a little lenient though because these numbers are not always exact. Close to 49 would be logical Stops: Short KLAC near How to use the Fibonacci Calculator.

The Fibonacci calculations are based on the high and the low of the day in KLAC. Prior to the snapshot of the chart in the section above the stock had hit more extreme lows and highs. These snapshots were both taken at the same time.

The absolute low of the day was The Fibonacci calculator offers us a different read on KLAC and it tells us some support and resistance levels that the charts don't. Notice the T1, T2, T3 levels offered in the calculator. The left column represents support levels and the right represents resistance levels.

If we chose to use the Fibonacci numbers to trade with we would be willing to do one of these 4 things: Buy KLAC if it breaks Try the following example.

Scroll to the bottom of this page for answers. Home About Us Free Trial FAQ Day Trading Swing Trading Long Term Trading.

Trading Styles Newsletter Site Map Stocks We Follow Credits Terms of Use Privacy Policy.